For would-be first-time home buyers who are in a good financial situation thanks to consistently saving and managing credit wisely, there can still be advantages to making that purchase in the near term, she said. Because both grants can be combined, eligible home buyers can receive up to $17,500 in aid toward their purchases. Bank of America is working to help people become first-time homeowners through an initiative targeting low- and moderate-income communities. If you have an FHA loan and are worried about foreclosure, this program offers alternatives for settling your mortgage debt. If you're struggling with your Bank of America home equity loan or line of credit payments, there may be options to change the terms to achieve more affordable payments. Before applying, applicants must complete a homebuyer certification course provided by housing counseling partners approved by Bank of America and the Department of Housing and Urban Development.

States will administer a total of $9.961 billion, subject to Treasury Department guidance. We have even more solutions, from assistance with credit cards to help with auto loans. If you have a loan that is not owned or insured by a government entity, understand how a loan modification may make your payments more affordable. If your loan is insured by the VA and you’re experiencing a hardship, a loan modification may make your payments more affordable. And/or mailing address for the purpose of fulfilling your home buying process inquiry regardless of any Do Not Call or other privacy choices you may have previously expressed. Once registered, you'll get access to all the videos so you can watch them whenever you want.

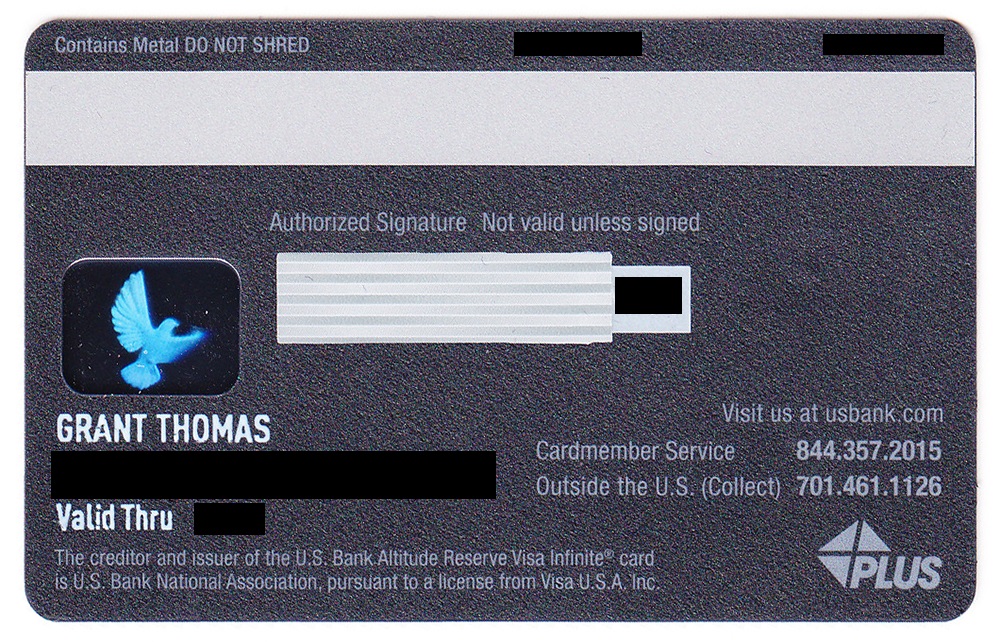

Bank of America Interest Checking®

The loans are subject to rigorous underwriting and are based on credit guidelines including on-time bill payments including rent, utilities, phone and auto insurance payments. No minimum credit score or mortgage insurance is required. The Bank of America First-Time Homebuyer Online Edu-Series® educates first-time homebuyers about affordable mortgages, down payment and closing cost grants and 5 steps to home buying. Our Down Payment Grant program offers a grant of up to 3% of the home purchase price, up to $10,000, to be used for a down payment in select markets. Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site.

Our loans reporters and editors focus on the points consumers care about most — the different types of lending options, the best rates, the best lenders, how to pay off debt and more — so you can feel confident when investing your money. Aylea Wilkins is an editor specializing in personal and home equity loans. She has previously worked for Bankrate editing content about auto, home and life insurance. She has been editing professionally for nearly a decade in a variety of fields with a primary focus on helping people make financial and purchasing decisions with confidence by providing clear and unbiased information. To learn more about relationship-based ads, online behavioral advertising and our privacy practices, please reviewBank of America Online Privacy Noticeand ourOnline Privacy FAQs. If you prefer that we do not use this information, you mayopt out of online behavioral advertising.

Programs in Rhode Island

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site.

Prospective buyers must complete a homebuyer certification course provided by select Bank of America and HUD-approved housing counseling partners prior to application. Black homeownership currently stands at just 45%, compared with white homeownership at 72%. CultureBanx reported that Black and Hispanic households are not reaping the real estate gains felt by other demographics, due to home prices appreciating so much that families of Color are being out-priced out of their very own neighborhoods. This is why the ‘Community Affordable Loan Solution’ can be a game changer since there is no minimum credit score or mortgage insurance required and home buyer eligibility is based on income along with location. The Down Payment Grant program will provide as much as $17,500 to buyers who can make monthly mortgage payments but would have problems coming up with a down payment and closing costs. The bank’s $5 billion commitment is expected to help 20,000 people buy a house nationwide.

Programs in Maine

If you opt out, though, you may still receive generic advertising. In addition, financial advisors/Client Managers may continue to use information collected online to provide product and service information in accordance with account agreements. If you are looking to purchase a home of your own, Bank of America’s home ownership solutions may be just what can help you get started. By combining down payment assistance and closing costs, you may find that a new home is within reach. To learn more about relationship-based ads, online behavioral advertising and our privacy practices, please review the Bank of America Online Privacy Notice and our Online Privacy FAQs. Customers will find online resources to become more financially fluent, establish or rehabilitate their credit and prepare for homeownership when it makes sense for them.

To date, the program has helped more than 36,000 individuals and families become homeowners. Two-thirds of the program's loans and grants made through the program have helped multicultural clients become homeowners, according to the firm. Down payment and/or closing cost assistance programs may not be available in your area. Down payment and/or closing cost assistance amount may be due upon sale, refinance, transfer, repayment of the loan, or if the senior mortgage is assumed during the term of the loan. Some programs require repayment with interest and borrowers should become fully informed prior to closing. Sales price restrictions and income requirements may apply.

Help for Homeowners

Applicants do not have to be Black or Hispanic/Latino to qualify for the loans. The program – called the Community Affordable Loan Solution – will be available in certain cities including Black and/or Hispanic/Latino neighborhoods. For more information on our programs and opportunities for collaboration. A place to call your own and put down roots—it’s a dream for people from every walk of life. We are dedicated to helping individuals and families buy a home that’s exactly suited for their needs. We ask for your email address so that we can contact you in the event we're unable to reach you by phone.

According to the National Association of Realtors, today there is a nearly 30-percentage-point gap in homeownership between White and Black Americans; for Hispanic buyers, the gap is nearly 20 percent. And the competitive housing market has made it even more difficult for potential homebuyers, especially people of color, to buy homes. The Down Payment Grant program gives eligible buyers 3% of a home's purchase price up to $10,000, whichever is less, towards a down payment with no repayment required. That funding is available in more than 260 cities and counties.

Additionally, the bank could waive lender origination fees, usually about $1,000, for loans backed by federal agencies such as Freddie Mac, the Federal Housing Administration and the Veterans Administration. If the homes are considered to be in a “medium” or “upper” income area, there is a cap on the applicant’s earnings based on 80% of the income in that area. For the greater Riverside and Moreno Valley area, for example, that cap would be $52,640 a year, Deason said.

Bank of America’s Community Homeownership Commitment® is bringing together products and resources that can help modest-income borrowers buy homes of their own. By combining down payment assistance and closing cost help with a low down payment mortgage, you may find that a new home is within reach. Dawn Lee, executive director and CEO of the San Bernardino-based nonprofit, said they provide eight hours of group counseling on homeownership for BofA grant applicants, which is a mandatory part of the process.

GRANT programs are available to offer qualifying home buyers up to $17,500. "The market is competitive, so you definitely want to make sure you're pre-approved because it could take longer if there are competing offers, which we're seeing a lot of," Barkley said. The pandemic has also inspired prospective first-time buyers to seek more outdoor space, financial safety and security, as well as the opportunity to make their families proud, she said.

We might permanently block any user who abuses these conditions. “If people can’t come up with that initial trough of money, then they can’t come in the door,” she said. The site also states that these grants are not always available and to inquire for details. Up to $10,000 can be granted through this program, bringing up the total potential amount to $17,500. These programs are part of the Bank of America Community Homeownership Commitment, which began in 2019. For those who want to buy farther out, now could be a good time to evaluate their finances and budgets and understand where their money is going.

Americans eligible for monthly direct payments between $50 and $2,000

The Bank of America Down Payment Center is managed by Bank of America. Information on the DPC is provided as a resource for your convenience and is not a verification of, prequalification for, application to, or approval by, any third party program provider or for any mortgage or other financing. Third party program providers supply the information displayed in the DPC and determine eligibility requirements for all programs. Program availability and eligibility criteria are subject to change without notice.

No comments:

Post a Comment